The Policy and Regulatory Report (PaRR) has just informed me that "[t]he European Commission (EC) will hold an oral hearing next week as part of its market investigation into Microsoft’s [NASDAQ:MSFT] acquisition of Activision Blizzard [NASDAQ:ATVI]" and refers to confirmation by "a spokesperson for Microsoft." The exact date is Tuesday, February 21. The venue will be one of the Commission buildings in Brussels. A courtroom-style clash between Microsoft and Sony is virtually certain to happen on that occasion.

It became known two weeks ago that the European Commission's Directorate-General for Competition (DG COMP) had sent Microsoft a Statement of Objections (SO) over its proposed acquisition of Activision Blizzard King.

An SO is a preliminary antitrust ruling. Reporters often refer to an SO as an "antitrust warning" that can come down in different categories of competition cases. For instance, about two years ago the EC issued an SO against Apple's abuse of App Store market power against Spotify and other music streaming services, but an actual decision has yet to be made in that unilateral conduct case.

In the Microsoft-ABK merger case, there is a clear deadline: April 11, 2023. After an SO, a party gets access to the case file and can--as Microsoft apparently did--request a merger hearing in Brussels. This means Microsoft will be able to read--and respond to--Sony's submissions to the EU Commission. Sony could request that some or all of its submissions be kept confidential, but the Commission could not rely on confidential facts in its decision (and any potential appeal of such a decision to the Court of Justice of the EU).

As PaRR notes, such merger hearings are attended not only by the Commission's case team working on a merger but also by other Commission officials and third parties.

I have no doubt that Sony--which is fighting Microsoft's subpoena in the U.S. FTC proceeding--will participate, and the question is whether Google and/or Nvidia will do so as well. Sony is the only vocal complainer, and Nvidia is not a complainer in a strict sense (as its position is not that the merger should be prohibited) but merely seeks to opportunistically benefit from those merger review processes in the form of a license deal that might benefit its GeForce NOW cloud gaming service.

I attended an EC merger hearing in 2009 (Oracle-Sun Microsystems) as a complainant, so I know how those hearings go. The case team presents its theories of harm, the parties get to respond, and third parties can intervene (as Sony undoubtedly will) to urge the Commission to block the deal or insist on drastic remedies.

The EC officials who attend such hearings include representatives of other DGs (directorates-general), who may or may not agree with the case team. Close aides to the competition commissioner are also present. I can't imagine that European Commission EVP (and antitrust chief) Margrethe Vestager won't send a member of her cabinet. Given the high profile of this case, even Mrs. Vestager's Chef de Cabinet Stina Soewarta may attend the hearing in whole or in part. Again, this is all speculation based on my own past experience with how those merger hearings work.

Third parties who wish to attend will now have to reach out to one of the EC's Hearing Officers and explain why they believe they have a right to be heard.

Representatives of national competition authorities of EU member states, such as Germany's Bundeskartellamt (BKartA, Federal Cartel Office) or the French Autorité de la concurrence (Adlc), also have the right to attend.

A merger hearing is very similar to a trial, but it is not public. A decision is not announced immediately, but the case team working on this particular merger review may state its recommendation (such as whether the deal should be cleared unconditionally, with conditions, or not at all) at the end of the day.

After the hearing, negotiations between the Commission and the acquirer typically continue.

Microsoft has repeatedly and consistently stated its interest in addressing any potential competition concerns and finding solutions. Working out an agreement with the European Commission--one of the world's most well-respected antitrust enforcers--could be an inflection point and lead to settlements in other jurisdictions.

The Competition & Markets Authority (CMA) of the United Kingdom may soon hold a similar hearing. Last Wednesday, the CMA issued its provisional findings, which are the UK equivalent of a DG COMP SO (initial reaction, observations on full 277-page document, and further analysis of the remedies notice). According to its administrative timetable, the CMA will hold "[r]esponse hearings (if required)" in late February or early March. Whether such hearings will indeed take place has not been announced yet, and that's why the exact date is unknown.

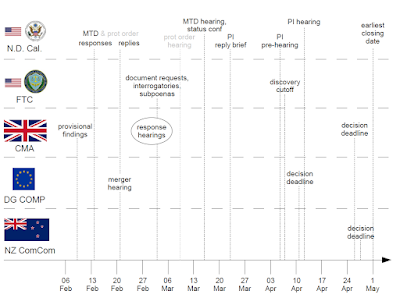

I have updated my timeline chart to reflect the EC merger hearing (click on the image to enlarge):

Other changes since the previous version of that chart include that I have grayed out the motion process for the protective order (i.e., rules for the protection of confidential documents) in the Northern District of California, given that the parties recently submitted a negotiated proposal.

Here's a table of the key acronyms:

| N.D. Cal. | United States District Court for the Northern District of California |

| MTD | (Microsoft's) motion to dismiss (the so-called gamers' lawsuit) |

| prot order | protective order (i.e., protection of confidential business information) |

| PI | preliminary injunction |

| FTC | (United States) Federal Trade Commission |

| CMA | (UK) Competition & Markets Authority |

| DG COMP | (European Commission's) Directorate General for Competition |

| NZ ComCom | Commerce Commission of New Zealand |

Note that all of this is in flux and some of those events may not (have to) happen. For instance, if the motion to dismiss is granted in California, even if only in part, this may have implications for the preliminary injunction (possibly even obviating any PI hearing).