Since OPPO's withdrawal from the German market in August, things haven't gone too well for Nokia in its dispute with the Chinese smartphone giant. The exceptions all just confirmed previous wins. For example, Nokia prevailed (on two near-identical patents from the same family) in what is just a tiny market for OPPO: the Netherlands. Also, as the Karlsruhe Higher Regional Court confirmed to me yesterday, it denied OPPO's motions to stay the enforcement of Nokia's Mannheim injunctions (which doesn't mean that OPPO's appeals couldn't succeed; the hurdle is high for such stays in Germany, far higher than in the U.S. where the balance of hardships plays a key role).

In various other regards, those two months have been dreadful for the Finnish wireless company, which is generally managing its patent business very well and has a lot of growth opportunity in that area, but needs an exit strategy from the increasingly costly (not only--but also--in terms of fees) tit-for-tat with OPPO. If things go on like that, Nokia risks finding itself in a Vietnam-style quagmire at a time when some more important renewals are on the horizon.

Nokia had a perfect start: four out of four decisions in Germany (two in Mannheim, two in Munich); or five out of five, but again, two of those patents are barely distinguishable from each other, which is why I count them as one. I could imagine a number of defendants--even more lucrative targets than OPPO--that would have settled at that stage. But OPPO is amazingly resilient. Other patent holders than Nokia will be watching those developments with concern.

After those first four German injunctions, the Dusseldorf Regional Court stayed two Nokia v. OPPO cases, as did the Munich I Regional Court about a month ago.

In a jurisdictional decision, China's Supreme People's Court remained consistent with its OPPO v. Sharp caselaw: according to Chinese media reports, a global FRAND license fee is now going to be determined in China. I haven't been able to find out whether it would be an option for Nokia to leave the Chinese market (should it consider refusing to comply), but it's a huge market for telecoms infrastructure (though Nokia's share may be very low) and a local joint venture (Nokia Shanghai Bell Co., Ltd.), with respect to which Nokia informed its shareholders (PDF) of a financial liability:

"Other financial liabilities mainly include a conditional obligation to China Huaxin as part of the Nokia Shanghai Bell definitive agreements where China Huaxin obtained the right to fully transfer its ownership interest in Nokia Shanghai Bell to Nokia in exchange for a future cash settlement. The financial liability related to the conditional obligation is measured based on the expected future cash settlement with any changes recorded in financial income and expenses in the consolidated income statement. "

A Chinese FRAND determination might provide Nokia with an exit from a war it may never be able to profitably win. Nokia could accept those terms and later tell courts in other jurisdictions that those terms should not be a comparable for the purposes of a FRAND determination in a hypothetical Nokia v. Apple, Nokia v. Samsung or similar case in a jurisdiction like the U.S., UK, or Germany.

OPPO has recently also landed some punches in key Western jurisdictions:

The Mannheim Regional Court yesterday confirmed to me that today's Nokia v. OPPO trial has been canceled. As the court told me, Nokia has withdrawn its Mannheim complaint against OPPO affiliate OnePlus (known for high-end Android devices) over one of the two patents on which Nokia had prevailed in Munich--EP3557917 on a "method and apparatus for providing efficient discontinuous communication." Previously the court (the case was pending before the Second Civil Chamber under Presiding Judge Dr. Holger Kircher) had advised the parties of its preliminary opinion that the patent did not appear to be actually infringed, contrary to what the Munich court had determined against OPPO (as opposed to OnePlus).

Last week, the Patent Trial & Appeal Board (PTAB) of the United States Patent & Trademark Office (USPTO) granted an OPPO petition and instituted an inter partes review of a Nokia patent as OPPO "has shown a reasonable likelihood that it would prevail with respect to all claims challenged in [its petition]" (click on the image to enlarge):

There isn't any infringement litigation in the U.S. between Nokia and OPPO. It's the most transparent jurisdiction, so we would know. This means OPPO itself decided to take the fight to the United States, which is another sign of how determined OPPO is to chase Nokia around the globe.

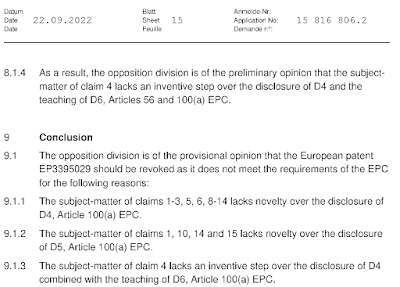

The PTAB decision follows a preliminary opinion by an opposition panel of the European Patent Office, according to which the European patent from the same family has been deemed invalid (click on the image to enlarge):

In the EPO's preliminary opinion, most of the claims even lack novelty, and claim 4 lacks an inventive step.

While Nokia has a lot of patents and some "weeding out" may be desirable, one question must be asked: is this profitable?

It's not even clear what percentage of its German sales OPPO is actually losing at the moment: Deutsche Telekom (T-Mobile) is still selling three OPPO and two OnePlus devices. And that carrier is a large Nokia customer, so I doubt that Nokia will sue them.

Patent licensing firm IPCom sued Nokia in the 2000s because it was the most lucrative target at that point. The alternative would have been to focus on softer targets. Now it could be that Nokia did everything right except for having underestimated OPPO's ability and determination to defend itself. The ROI of suing some other implementers in the meantime--especially some who are susceptible to German injunctions and for whom it would not be an option to withdraw from the market--would likely have been higher.